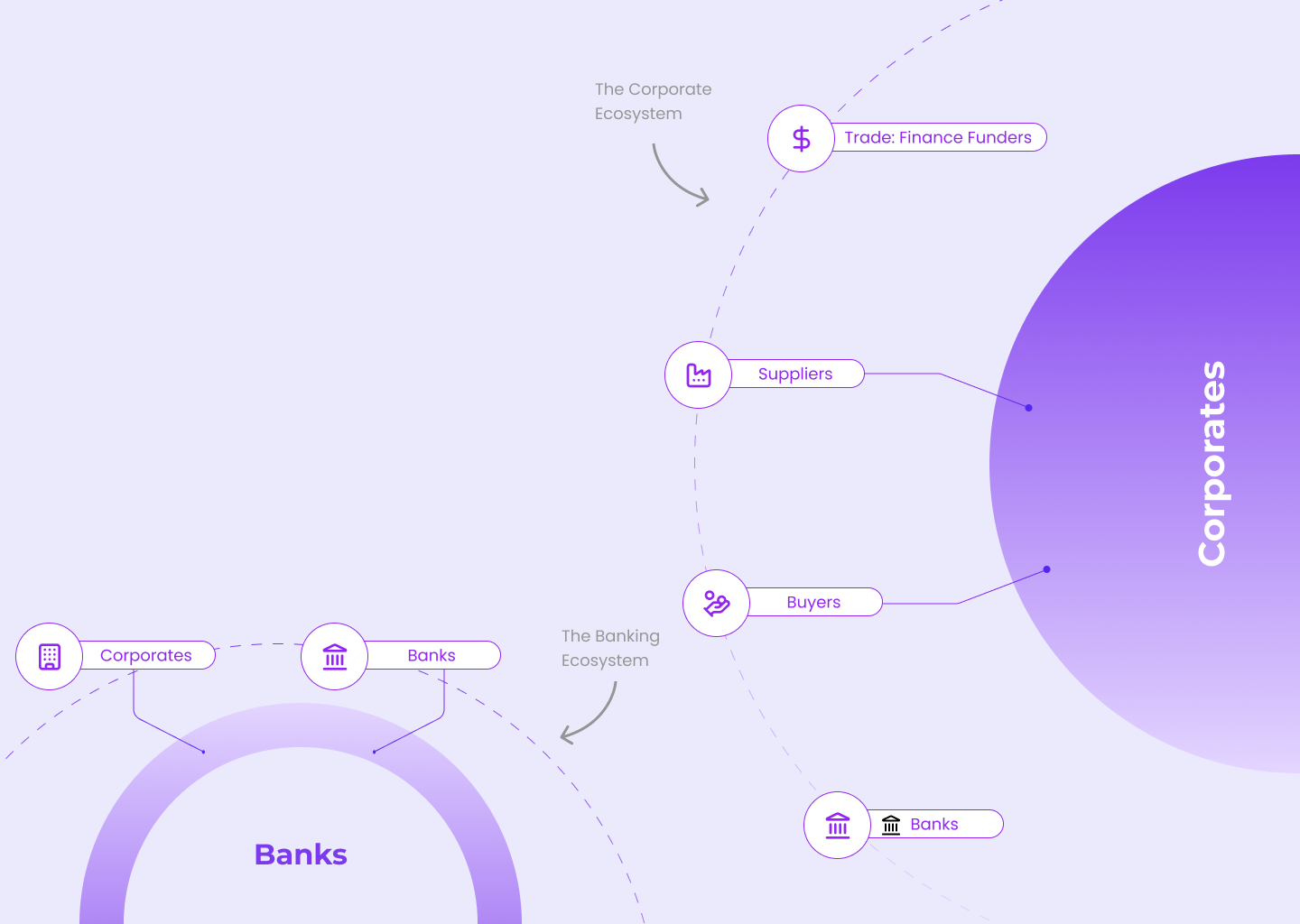

A revolutionary single deal making platform digitizing the

trade finance landscape between Corporates and banks; as

well as bank to bank deals.

Short links

Other pages

A revolutionary single deal making platform digitizing the

trade finance landscape between Corporates and banks; as

well as bank to bank deals.

A revolutionary platform digitizing the trade finance landscape

between Corporates and banks; as well as bank to bank deals

Trade origin is a digital trade finance platform created under the umbrella of techsol management consultant ,a company specializing in digital solutions for financial markets and corporates. Our team experienced in financial markets and technology, excels in creative problem-solving, integrating automation with the latest technology to address organizational challenges and develop improvement plans. Trade Origin was developed as an in House digital Trade Finance platform and the need to cater to global changing Trade finance requirements.

INTRODUCTION

TradeOriginA revolutionary platform digitizing the trade

finance landscape between Corporates and

banks; as well as bank to bank deals

PROBLEMS FOR CORPORATES

Stuck with few banks, missing out on competitive pricing from larger banking network.

Uncertain about market pricing of trade products, therefore missing out on optimal pricing.

Middlemen fees and opaque pricing eat into profits.

Legacy processes of emails and phone calls waste time sourcing the best trade finance pricing.

Lacking insights on global bank risk and country risks.

Corporates and banks depend on few networks to mitigate their payment risk.

PROBLEMS FOR BANKS

Banks work in traditional ways to source trade finance business and need to embrace technology for executing their trade transactions as well as reaching untapped source of business

SOLUTION FOR BANKS & CORPORATES

Compare & secure deals and opportunities from Banks and Corporates locally & worldwide.

Slash processing times with automated digital workflows.

Go Green - ESG Benefit

Track progress & insights on one digital platform with just few clicks.

Easy Audit trail and following Compliance parameters

Reducing financial costs on your trade finance transactions for gaining best pricing from multiple banks

Gain unmatched risk pricing data on Countries and Banks for informed decisions.

Track real-time analytics, insights and deal progress of your business

89% Banks struggle with finding viable connections ,

Risk mitigation in new markets and most importantly

deal sourcing.

CREATION